It seems as if this year has been full of opportunities and challenges. Being a farmer, I must admit the challenges seem to carry the heaviest weight in 2023.

This spring provided the most perfect planting weather that I have ever experienced. Nearly all our crops were planted without the interruption of rain. In my immediate area, we never experienced the major storm we usually get that packs the ground or causes the need for replanting.

Prices throughout the spring remained very good for most commodities, giving producers the opportunity to price the 2022 crop still on hand and to pre-price the 2023 crops at very profitable levels.

At the same time, farmers were noticing the weather becoming drier than normal. This discouraged many producers from setting price floors for the fall while the market was eroding to current levels.

The first week of August we saw widespread rains come through that gave some of the corn and soybeans a second chance for the season. Currently though, we are in desperate need of participation.

Today, we find most of Missouri looking at yet another challenge. We are anticipating lower than normal yields for both corn and beans with prices below the spring guaranteed levels. Crop conditions were reported this week with levels that just exceed those of 2012. So, what is the plan from here? Do we store crops awaiting a price rally? If so, where do we think prices could go?

Let’s look at the world picture to get some guidance.

South America, mainly Brazil, is reporting the largest expected crop production in history. It was also reported in Pro Farmer that Brazil plans to bring an additional 98.8 million acres into production by converting pasture to row crop over the next 10 years. This addition is not good news as the US tries to remain a top player in the ag commodity business.

China is having economic problems currently. The US ag sales to China have fallen nearly 9% from a year ago, but their total imports were up over 17% for the year. They are still buying grain, but most of that is coming from South America.

To shorten a long story, the chances of a significant grain rally this fall seem limited. Both corn and soybeans have fallen into a sideways pattern since August. Local deteriorating crop conditions have done little to prop up this market.

Livestock producers are finding themselves outside of these doldrums. Feeder cattle prices are now positioning themselves to address all-time highs that we set several years ago. Fed cattle prices are good and still trending higher.

With the reduction in feed prices, the profitability of this livestock looks very promising. Many countries, including Canada, are still reporting a decline in herd numbers, thus doing nothing to reduce prices. The prices we are seeing for cattle right now will be our downfall as I do not think they can be sustained over the long term.

I predict two things will happen. First, high prices will force consumers to choose other protein sources to stretch the food dollar. If you are not a regular visitor of the meat counter, I would encourage you to go to the store and check it out. It will be easy to see what the typical shopper is faced with. Beef ribeye is commonly $12-$15/ pound while pork loin will be $3-$5 in some cases. I have a feeling that the consumer will start taking advantage of these price savings. In the long run we will lose beef demand.

The second thing that will happen is when producers make abnormal profits, they expand the operation by keeping back heifers for breeding stock. This expansion will take a couple of years to add to the calf herd, but when it does, the numbers will dictate lower prices.

So, what do we do on our operations in the short term to take economic advantage of this situation? First, we must assess what facilities we have and our management abilities. Some options producers are weighing on:

- Store grain for additional price rallies- it will come, but we must be realistic about what to expect.

Or

- Walk the grain you produce off the farm by feeding it to livestock. Even though feeder cattle are currently high, purchasing background calves will still generate some good profits.

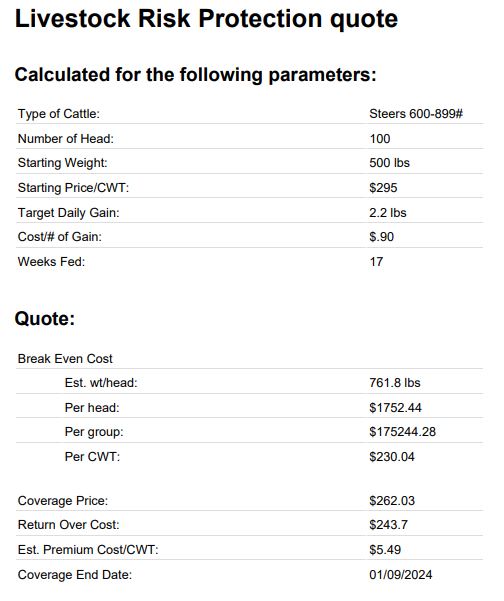

Below is a Livestock Risk Protection (LRP) quote showing coverage we placed for a customer this week.

As you can see this producer was able to place a minimum price floor under for his feeder cattle at $262.031 using LRP. This generated him profits on his operation (return over variable cost) of $243.702 per head. Remember this is the minimum, if the market goes higher, he can take advantage of the increases.

Another option producers are considering is buying cows.

If you have pasture or feed this is another venture that has very little short term downside risk. Buying cows gives a producer 2 ways to go to the market. Breed the cows and sell what you don’t have grass for or fatten the cows to go to the kill market. With the current beef cattle shortage, there should be a static demand for both replacement cows and slaughter cows in the short term. Most of the liquidation has already taken place, so the numbers of kill cows are getting short.

There is no price protection with LRP for feeding kill cows or buying replacement cows, however your pencil will show that this could even be more profitable than feeders at the current time.

Each year we are blessed with both opportunities and challenges, 2023-24 will be no different. The key is to be able to look at the markets and what resources we have around us while putting together a plan of action. No one plans to fail in this business, but sometimes many of us fail to plan.