Missouri Agriculture Lenders Express Mixed Feelings on Land Values

The following article was written by Ben Brown, MU Extension- Agriculture Business and Policy Team

When asked, producers- with a smile and a laugh- will likely say their lender is the most pessimistic within their circle of advisors- well at least outside university economists. Lenders are as a group cautious because extending loans comes with extrinsic risks even the most well-established farming operations might not be able to control. Highlighting these risks and identifying solutions are two objectives of MU Extension’s annual Agricultural Lender Seminars. For decades, MU Extension has provided learning opportunities about the economy for the state’s agricultural lenders. A team of University of Missouri economists specializing in markets, policy, and finance blanketed the state during November and December covering topics such as interest rates, inflation, commodity markets, and inputs. The Missouri Department of Agriculture’s Missouri Agricultural and Small Business Development Authority (MASBDA) and the Farm Service Agency (FSA) partnered to provide educational information on their programs. Throughout the program, lenders had an opportunity to share their expectations for the year ahead.

Expectations on the US Macroeconomy

The Federal Open Market Committee raised the federal funds rate seven times in 2022 to a benchmark range of 4.25%-4.50% to control price inflation. While relatively low in historical measures, lenders expressed their concern the increasing interest rate environment might have on asset values like land and operating accounts. Roughly 80% of the assets represented on a producer’s balance sheet are attributed to land values. Lenders were asked three related questions on their perceptions of monetary policy. Current forecasts by the US Federal Reserve as of November 1 were provided for reference. Most participants expected the consumer price index to exceed 4.2% from October 2022 to October 2023, unemployment would remain below 4.4% in 2023, and the Federal Funds rate would exceed 4.75% on October 31, 2023. “Key to this discussion is how rates for land ownership are influenced by short term Federal Funds rates” said Joe Horner, MU Extension Specialist.

Expectations on Agricultural Markets

Agricultural markets made abrupt moves in 2022 following the invasion of Ukraine, dryness in the western corn belt, potential rail strikes, and low water burdening river transportation. Lenders were asked 7 questions related to their expectations of certain agricultural markets. Current forecasts by the Chicago Mercantile Exchange as of November 1 were provided for reference. Lenders were largely unified in expectation of oil prices above $84 per barrel on June 1, 2023, national average retail anhydrous prices higher in April 2023 compared to October 2022, and feeder cattle prices above $200 per hundredweight on average during October 2023. Missouri lenders indicated they expect 2023 corn prices at harvest below $6.24 per bushel, Missouri producers planted below 630,000 wheat acres last fall, and corn exports out of the Black Sea Region will below 70% of normal. “If looking only at the supply side of cattle markets, it is not difficult to see feeder cattle prices moving higher” said MU Ag Economist Scott Brown “but supply is only one part of determining cattle prices”.

Missouri Land Values

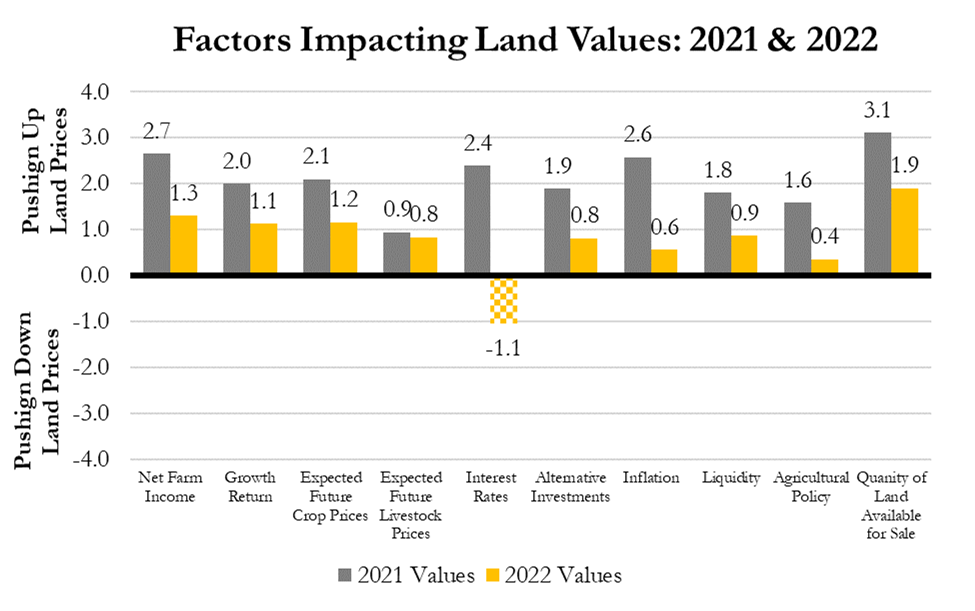

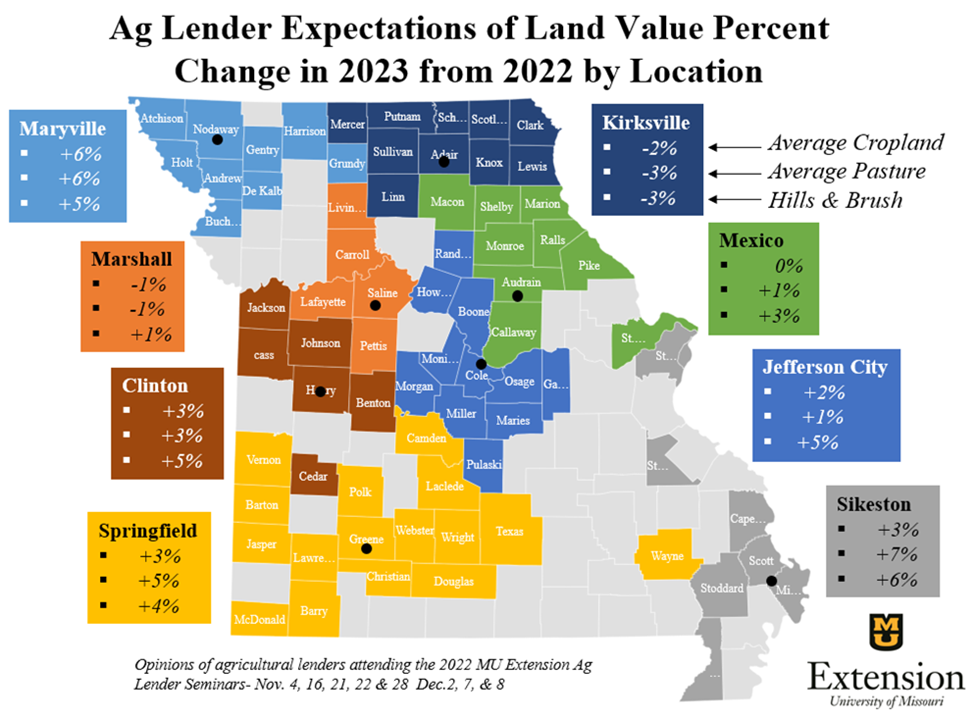

While attendees were relatively pessimistic about crop markets and high input costs, they were mixed about Missouri cropland values. Forty-four percent of attendees anticipate cropland values to increase in 2023 and twenty-eight percent anticipate land values to maintain current values. Similarly, forty-four percent expect pastureland values to increase while twenty-seven percent anticipate no change from 2022. Multiple factors impact land markets at any given moment. Outside factors such as interest expense and expected farm income exist factors including quantity of land on the market, location, characteristics of the bidders, development pressure, and built-up liquidity. Forty-four percent of attendees anticipate no change in the volume of land on the market compared to 2022 with twenty-two percent anticipating more land on the market and thirty-four percent anticipating less. Lenders were asked to provide their assumed 2023 farm ownership loan rate- ninety percent of responses fell between seven and eight percent. “It generally takes one to two years before we start to see higher interest rates impact land values, but even then, other factors are offsetting the increases in rates” said MU Ag Economist Ben Brown. Lenders seemed to agree. All ten factors impacting land values asked in 2021 and 2022 were down this year compared to last. Nine of the ten were viewed as supporting land values, with the lone factor pushing down land values- higher interest rates.