At the beginning of August, prices for most commodities were very depressing. Since then, all markets have rallied a significant amount for various reasons. However, we must remember that market prices are just a snapshot in time.

Corn

DEC 20 corn on August 1 was $3.20 per bushel, by mid-September this market had rallied over 50 cents to hit a high just short of $3.80. This increase was due to many different factors. The wind storms in the north damaged several acres thus reducing expected yield, China was aggressively buying corn and dry weather was reducing yield on a weekly basis.

Today, we are looking at a few different scenarios. Harvest has begun with great weather. This is allowing us to be slightly above the 5 year average with harvest progress. Harvest pressure tends to weigh on prices this time of year.

Last Monday, the uptrend in this market was broken and the nearby trend headed lower. Basis in parts of the area were under some pressure, but other areas where corn prospects were not as good, basis actually increased to some extent.

Looking at the chart on the previous page, we can see the movement of the market. On the chart we see that the 4 day has crossed the 9 day signaling that this market is running out of steam. This might be a good pricing opportunity for a producer to look at if it fits in their marketing plan.

Soybeans

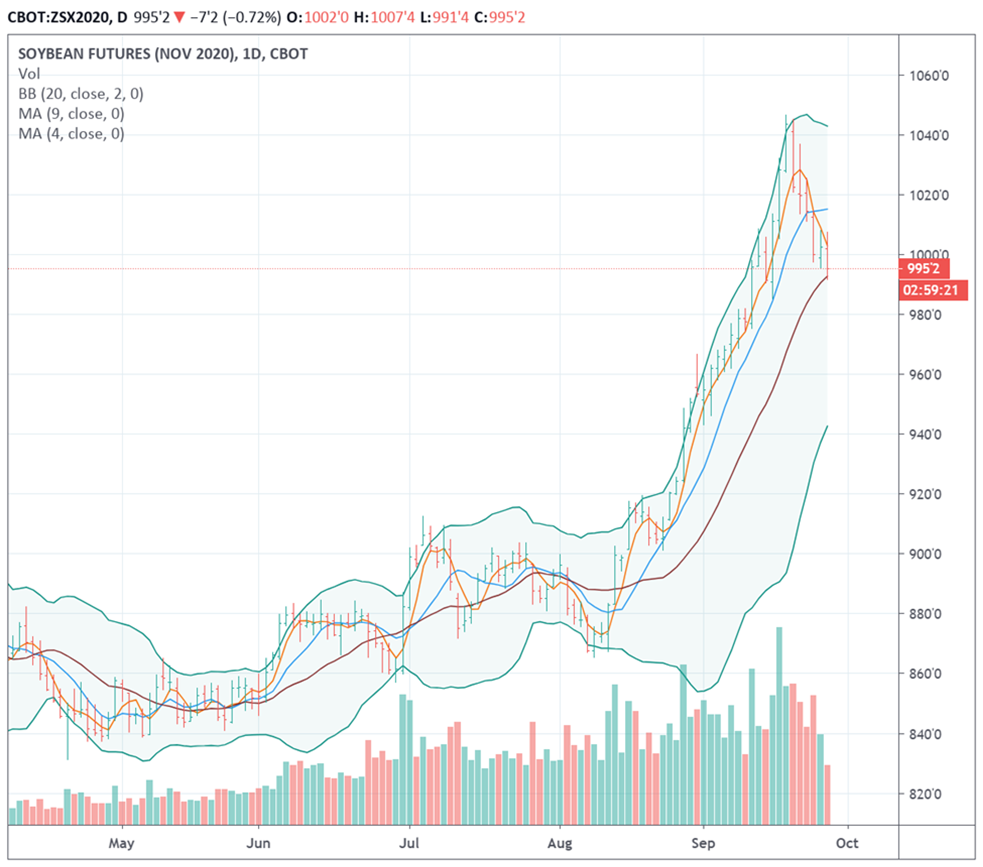

During the same time frame soybeans have also had an impressive rally. From memory, I believe there were 14-15 days in a row where beans finished higher. This market has gone up $1.80 per bushel during this period taking out some contract highs. The soybean rally was primarily fueled by aggressive Chinese buying. The commodity funds jumped into this market and took some extremely long (buy) positions while at the same time the commercial traders took some very short (sell) positions. Typically when the Commitment of Traders report shows this type of positioning, the market moves one way or the other very fast.

Last week this market started to break lower therefore we do believe that this will be the direction of the market in the short-term. On September 24th, the charts signaled that this market advance may be over. Producers selling at this level were definitely at profitable levels. Beans above $10.00 is a good thing but we also have to remember to add on the CFAP payments on top of our marketing price. With these added together the bean prices look very attractive.

Feeder Cattle

The current trend in the feeder cattle market is lower. The volatility of the market has decreased in the last few trading days but the trend is still down. Currently we are trading below the 20 day moving average and are coming into the time of year where historically markets tend to be weaker.

September’s Cattle on Feed report showed placements in August at 109% of a year ago. This may weigh on the market in the next week. One thing to remember is that when a report comes out the industry trades the news, however, this report seldom drives the direction of the market. Many times we have seen downward markets right after the report then upward movement in weeks following the report.

We have had a lot of producers place LRP coverage in recent weeks to protect themselves against falling prices. They found a place where they were establishing good profits and placed a floor or minimum price in the market. This leaves them open to upside potential in the markets but does away with the downside price risk. Producers in the feeder and fat cattle markets are mindful of what the “China” virus did a few months ago to prices. If it were to happen again and we had to close or limit our slaughtering capacity we would be silly to expect a different price reaction. Therefore, many of these producers are taking a proactive approach and establishing a floor with the LRP protection.

Live Cattle

This market has held up well in recent weeks. The trend is sideways and could remain fairly steady through the fourth quarter due to the supplies of market ready cattle. According to the Cattle on Feed report, in the first quarter of 2021 there will be a higher number of cattle ready for slaughter.

Looking at the chart we do see the 4 day below the 9 day line. Yet both are above of the 20 day moving average. There could be some weakness in the near term due to the Cattle on Feed report but it is thought that this damage will be at a minimum. In this market producers are also establishing price floors with LRP to keep current inventory at these profitable levels. Demand in the beef market has remained very good despite the wild fluctuations in retail prices.

The comments on these markets are the opinions of Dean Gibson and not intended to be used as marketing advice. We think that it is important to express what we are seeing in the market as we try to watch these every day. The information that we talked about in this article is what I use to make marketing decisions on my farm. It is important to have a marketing plan. This information is not intended to be suggestions for your operation.

I hope that you will look at this as an educational tool only and not to be used as marketing advice.