Today we are farming in very different economic times. Inputs and crop prices are high compared to the last few years. In the last 40 years of agriculture, I have never seen the market volatility that we are currently experiencing.

Many people speculate that the market unrest may not stop and that we could be in for another turbulent year. Because of these unknowns, I am reviewing alternate risk management programs that might work in situations such as these.

A few years ago, we offered a program called Margin Protection for those who wanted to experiment with a new type of coverage that was intended to protect a certain per acre profit. I enrolled into this program on my farm for a year to learn the ins and outs. It ended up that market conditions were good, and the program was very expensive, so I did not continue with this. For this year, depending on your operation, I believe this program may be better protection against the risk we are currently encountering.

As a reminder, here is how Margin Protection works. MP takes the projected county revenue and compares it to the projected county production costs to determine the expected county margin. A producer can select a percentage of that margin to cover from 70% up to 95%. We must remember that this program does not use a producer’s actual yields or their actual production costs. Rather, it is uses an estimated yield in a county for all producers and estimated input costs for the county, so all farms are held at equal value. A loss occurs when the county’s harvested margin is less than the calculated trigger margin.

There are three ways to trigger a payment under this program:

- If the county yield comes in lower than the county expected yield.

- If the margin harvest price falls below the expected harvest price.

- If harvest price input costs are higher than those projected input costs.

Any combination of these factors has the possibility of paying the producer an indemnity.

Why Look at Margin Protection Now?

This program protects most areas of concern producers have for the upcoming 2023 crop year.

Currently, the Margin Protection initial bushel prices are being calculated for the upcoming growing season (average of the CME futures Aug 15 – Sep 14, currently at $6.00/corn and $13.57/Sbean). With the higher than normal corn and soybean prices this could establish a high county revenue for 2023. With the world situation in regards to Ukraine, we have a difficult time predicting how unrest could affect market prices. We also question what Brazil and the South American crops will be like during their growing season. There could be valid arguments for both directions of price movement. By having a different price discovery time from your MPCI coverage (the average of the corn and soybean futures in the month of February), this program gives producers an extra five months of price protection during a critical time while making financial plans for the upcoming season.

Who would have guessed a year ago that fertilizer prices would be where they are today? With much of our fertilizer coming out of Russian controlled lands do we expect the prices to come down soon?

Energy costs have eased slightly as the economy has slowed, but few analysts expect this trend to continue. Many have worries about a global energy crisis and continued escalation of energy prices.

These are only a few of the concerns for the future that we cannot predict. During MP price discovery for grain prices (Aug 15- Sept 14), input costs (diesel, nitrogen, DAP, potash, interest, etc.) are also calculated for this program. This is how the county margin is set for the Margin Protection program, after September 14th, RMA will take the expected county yield times the coverage price and subtract the expected input costs.

The Margin Protection product protects a producer from all three of the items: low county yields, falling prices, and increased input costs.

This product has a few down sides that need to be recognized by a producer when MP is being considered.

- The cost of this product will seem high as it is less subsidized than a normal MPCI policy.

- The individual’s personal yields will not be considered. Only county yields will be used for figuring indemnities. It is possible for an individual to be wiped out and the county still have good yields. In this case, the producer would not be paid through MP for their individual losses. This situation could be flipped as well. A producer has good yields, but the county yields are low. In this instance, the producer could be paid an MP loss.

- Indemnity payments are not made until the summer of the following year since it takes RMA time to calculate county yields. Payments for 2023 will not be made until the summer of 2024.

- There is no replant or prevented plant coverage included with MP.

Even with these down sides there may be a place for this product for some producers. Area crop insurance plans are nothing new, but this is the only product that offers the opportunity insure margin.

This program gives you the opportunity to insure at a higher coverage level than your basic insurance policy, as you can insure up to 95% of the county’s margin.

Margin Protection can also be combined with your current crop insurance policy. Combining MP with a personal MPCI policy gives the producer replant and prevented plant coverage that most of us need. A discounted MP premium is also given when used with other crop insurance products. The reason there is a discounted premium when combined with other crop insurance policies is, if a loss is generated on both policies, you are only guaranteed the higher of the two losses. The amount of the discounted premium cannot be determined until acres are reported of the coverage year.

2023 Quote

(This will not be accurate until after September 14th when prices are set. This quote is based on corn priced at $6.00)

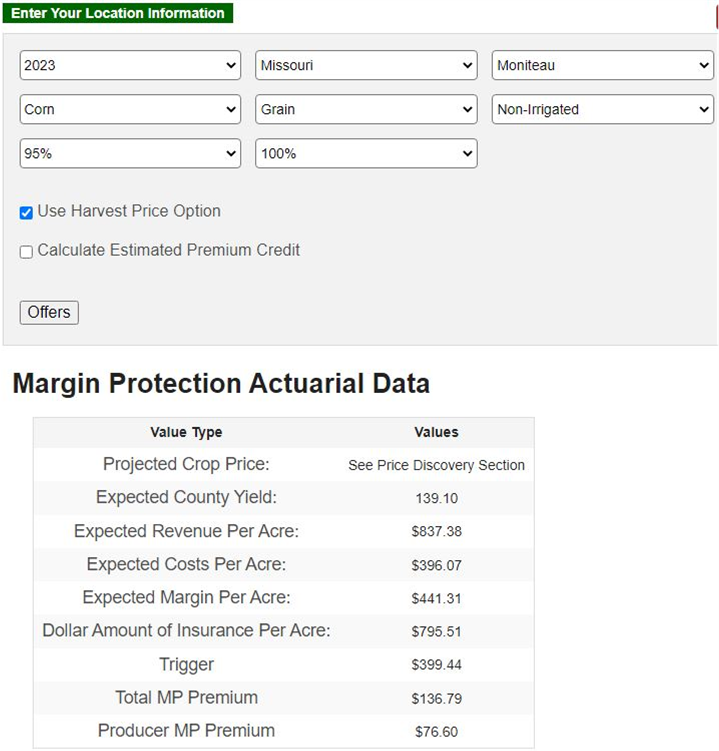

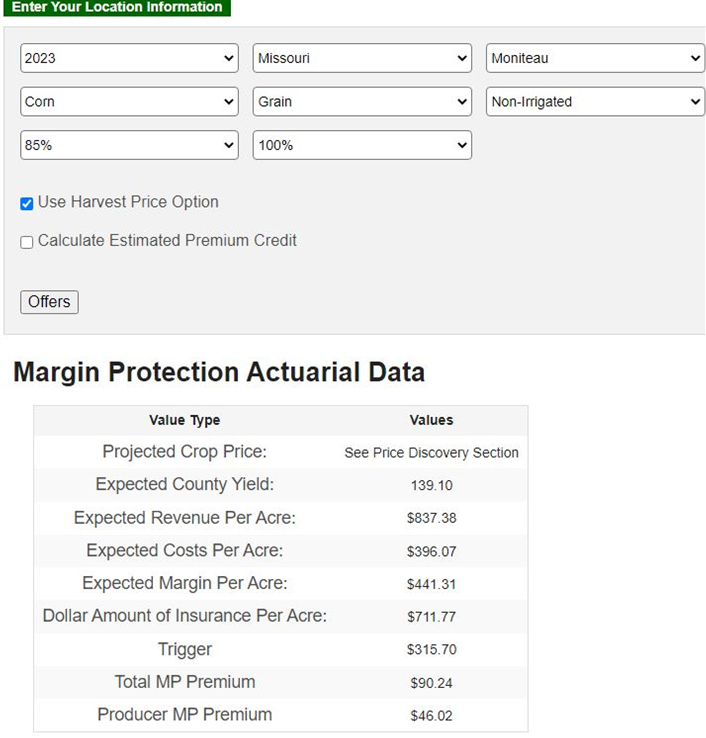

These are two examples of quotes in Moniteau County, MO. It is important to remember that it is almost impossible to quote MP with the premium discount without knowing the pricing for the underlying MPCI policy. These quotes are the full premium and show no premium discount. The first picture is showing the full coverage at 95%. It protects a $399.44 margin while costing $76.60/acre. The second quote is quoted at 85%, this is protecting a $315.70 margin and it costs $46.02/acre. There are many coverage levels to look at, these are only two examples. If this has sparked an interest call the staff at Gibson Insurance Group for accurate quotes for you and let us help you determine if this is a good fit.

Again, the current world economic situation we are in has brought this product back to the forefront and we think it is a good time to take a another look at how Margin Protection works. While we know this product will not be for every producer, it may hold value in certain situations. The sales period for Margin Protection is very short, but we are ready to meet with you and discuss the options. Applications for the 2023 crop year are due by September 30th, 2022.

Pros:

- Price Discovery Aug15 – Sept 14, 2022. Gives producers an extra 5 months of price protection

- Can insure up to 95% of the expected county margin

- Can potentially pay out even in your farm does not trigger a loss

- Takes into consideration the variable costs to put out a crop

- Can be used in conjunction with your underlying MPCI policy

Cons

- High premium cost

- Area based program

- No Replant or Prevented plant coverage

- Indemnity payments not made until the summer following the coverage year

- If combined with another crop insurance product, the MP premium discount amount is not known until acres are reported